For cannabis business owners, cannabis cultivation CapEx decisions made in Q1 do more than shape operations. They lock in tax outcomes that are difficult—or impossible—to reverse later. Once returns are filed, capital investments at the cultivation level determine how much cash stays in the business, how quickly costs are recovered, and how exposed the operation is to audit risk.

The pressure in Q1 is structural. Facility build-outs, equipment purchases, and expansion commitments are often approved while prior-year returns are still being finalized and estimated payments calculated. Under Section 280E, these early capital decisions directly affect cost recovery, depreciation timing, and taxable income. What feels like an operational green light in January often becomes a permanent tax position by April.

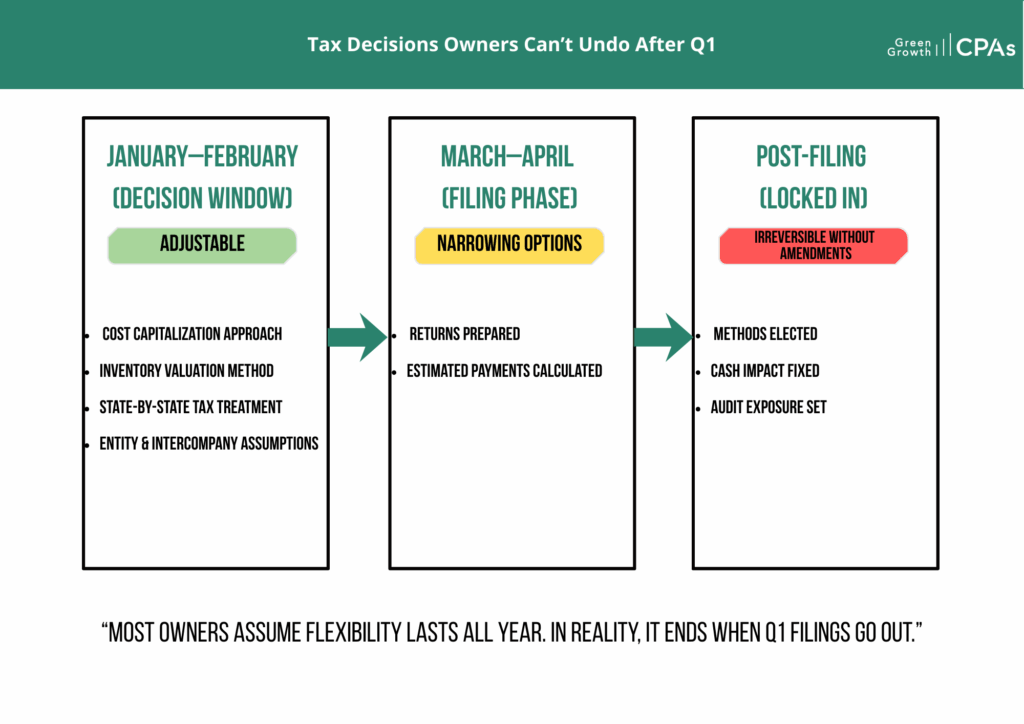

Most owners don’t intend to make irreversible decisions this early. But when cultivation capital spending is approved before tax treatment is fully evaluated, the outcome is the same. Once Q1 filings go out, flexibility disappears.

Why cannabis cultivation CapEx decisions are irreversible in Q1

The biggest risk in cannabis cultivation CapEx isn’t overspending. It’s committing capital before understanding how that investment will be treated for tax and audit purposes. Once a cultivation facility is placed in service and returns are filed, depreciation methods, capitalization rules, and cost allocations are largely locked.

The tradeoff in Q1 is speed versus control. Moving quickly keeps projects on schedule, but it also cements assumptions around asset classification, useful life, and cost treatment. In cannabis, where deductions are already limited, misclassified CapEx can permanently reduce recoverable costs.

The consequence shows up later as higher taxable income and tighter cash flow. The timeline is unforgiving: before filing, adjustments are possible; after filing, changes usually require amended returns and draw scrutiny. That’s why Q1 matters more than any other quarter for cultivation investments.

Common tax traps in cultivation capital spending

One common mistake is treating all cultivation investments as standard fixed assets without evaluating how costs can be allocated or capitalized. Grow room build-outs, HVAC systems, lighting, and environmental controls may qualify for different treatment depending on how they are structured and documented.

Another trap is separating operational decisions from tax consequences. Owners often approve cultivation capital expenditures based on yield, efficiency, or compliance needs alone, without assessing how those assets interact with 280E limitations. The result is capital tied up in assets that generate taxable income faster than cash.

A third issue is inconsistency across facilities or states. Multi-site operators frequently apply different assumptions to similar investments, creating audit exposure. The tradeoff is execution speed versus defensibility. The consequence is higher tax and more difficult audits.

Evaluating your cultivation CapEx strategy before filing

Q1 is the only realistic window to evaluate whether your cultivation facility CapEx aligns with both operational goals and tax reality. Once assets are placed in service and filings move forward, most adjustments become costly or unavailable.

Owners should review recent and planned capital investments tied to cultivation and confirm how those costs are being treated. This includes asset classification, depreciation methods, and whether supporting documentation would hold up under scrutiny. Small assumptions made early often drive large outcomes later.

This review takes time, but the alternative is worse. Locking in assumptions without evaluation means living with the cash impact all year. For owners, this is not an accounting exercise. It’s a capital allocation decision with long-term consequences.

Steps to optimize cultivation CapEx decisions before filing

Before filing, inventory all cultivation-related capital spending approved in Q1. Confirm asset classifications and depreciation methods are consistent across facilities. Review whether any costs were improperly excluded or included and whether assumptions match how the operation actually runs.

Align capital approval timing with tax filing deadlines. The visual included in this post illustrates why this matters: once filings go out, most cultivation CapEx decisions move from adjustable to locked in. Extensions can be a strategic tool when they allow proper evaluation rather than rushed conclusions.

At this point, the question is direct. Are you comfortable locking in your current cultivation CapEx treatment for the year, or do you need to reassess before filing removes that option?

What owners should confirm before Q1 filings go out:

Before returns are finalized, owners should be clear on three things:

- Which cultivation investments were approved before tax treatment was fully evaluated

- Whether asset classification and depreciation assumptions match how facilities actually operate

- How these capital decisions affect taxable income and cash availability for the rest of the year

Once filings are submitted, these assumptions become difficult to change. At that point, the discussion shifts from what is optimal to what is locked in.

Personalized recommendations help show your customers that you understand their preferences. Leverage customer data to provide tailored experiences:

✍️ By Daniel Sabet, Cannabis CFO & Financial Advisor at @GreenGrowthCPAs. Daniel advises cannabis operators nationwide on finance, compliance, and strategy.