As a business owner, filing taxes can be stressful. But failing to file your taxes on time can result in hefty penalties and potential legal issues, making it important to stay on top of the process. This can be especially difficult if your business is an S corporation or partnership. These are considered pass-through entities, where income and expenses pass through to the owners. This means that the business itself usually doesn’t pay income tax, but it still needs to file. In this blog post, we will explain what failure to file penalties are and provide tips on how to mitigate them so that you have one less thing to worry about this tax season rolls around.

What are the Penalties?

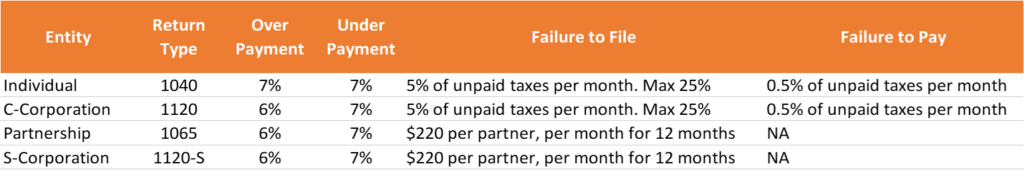

Businesses who don’t file or pay their income tax returns contend with two primary IRS penalties: Failure to File and Failure to Pay. On top of the penalties themselves, businesses will accumulate interest on the outstanding penalties. For partnerships, if these aren’t paid partners or investors may even be held individually liable.

Failure to File Penalty

This Penalty is based on how late you are to file your tax return and the amount of unpaid tax as of the original payment date. For individuals and C-Corporations, the penalty is 5% of the total unpaid taxes for each month that the return is late, up to 25% of the total amount owed. When it comes to Partnerships and S-Corporations the penalty is $220 per partner, per month for 12 months.

Failure to Pay Penalty

The Failure to Pay penalty for individuals and C-Corporations is 0.5% of unpaid taxes for each month overdue. It will not exceed 25% of the total amount owed. Partnerships and S-Corporations are exempt from these penalties. This penalty is as of the original due date, so businesses will begin accruing fees even if they file an extension.

Penalty Interest

On top of the penalties, the amounts owed will begin to accrue interest, further increasing the financial burden on businesses. Individuals face a 7% interest rate on over and under-payments, while Partnerships, S-Corporations, and C-Corporations all face a 6% interest on overpayments and a 7% interest on underpayments.

Mitigating Existing Penalties

If you know you won’t be ready to file on time, there are some strategies to help reduce your penalties.

- Request penalty abatement for reasonable cause from the IRS. You may be able to have penalties removed if the IRS determines you had reasonable cause for the delay.

- Request penalty abatement for a first-time penalty from the IRS. If this is your first time missing the filing and/or payment deadline, you may be able to qualify for a first time abatement.

- Set up a payment plan. Businesses are able to work with the IRS to develop payment plans to get back on track.

- Remember to file extensions if you will not be able to make the filing deadline. Just keep in mind that payment dates are not extended.

Failing to file your returns on time can come with penalties that significantly increase the amount you owe. We understand how stressful and difficult it can be to face these kinds of financial repercussions. Our CPAs are here to ensure that your taxes are filed correctly and up-to-date. If you’re already facing penalties, they will work with you to set up payment plans, request abatements, or file extensions.

For more tips and help with the IRS, reach out to our team of financial experts at GreenGrowth CPAs. We are here to help your cannabis venture through any level of the accounting, tax filing, or business cycle.

We employ several financial programs to assist the company with its fiscal responsibilities, including tax planning and compliance, accounting & finance support, audit preparation, tax controversy support, and much more.