As the cannabis industry continues to grow and evolve, business owners face unique challenges, especially when it comes to payroll. Federal regulations surrounding cannabis make it difficult for these companies to find banking partners and payroll providers. Business owners know the struggle of being kicked off a platform as providers change their stance on cannabis – most recently major provider PayChex. This can lead to delays in payments, increased costs, and a significant drain on resources which are all out of the businesses control. In this article, we’ll discuss payroll optimization strategies that cannabis businesses can control, including ways to improve efficiency and reduce costs.

Why Focus on Cannabis Payroll Optimization?

Optimizing payroll processes is crucial for cannabis businesses as it directly impacts their expenses, making it one of the key reasons why businesses should invest time in this process. After the cost of goods sold, payroll is one of the most significant expenses. Getting these costs in check goes a long way to improving your bottom line.

Payroll Checkup: Are You Getting It Right?

If you’re wondering how your payroll processes stack up, answer the following questions:

- Is your payroll as a percentage of revenue correct?

- Are you spending too little, or too much on payroll?

- Do you have the correct OKR (objective key results) system to incentivize your employees to drive revenues and profits?

If you were unsure about any of these questions, don’t worry. Finding the balance can be difficult as it is always changing. We suggest that our clients start by addressing two area’s first – quantity and quality of labor.

Quantity of Labor

One area that cannabis operators should focus on when it comes to payroll optimization is the quantity of budtender hours. It’s important to ensure that payroll staffing levels are in line with transaction counts to avoid overstaffing or understaffing. By comparing data from time tracking to transaction counts, businesses can determine whether they need to adjust staffing levels to maximize efficiency and minimize costs. Our analysis has shown that, on average, cannabis businesses can save between $24,000 and $36,000 annually by eliminating wasted hours in payroll staffing levels.

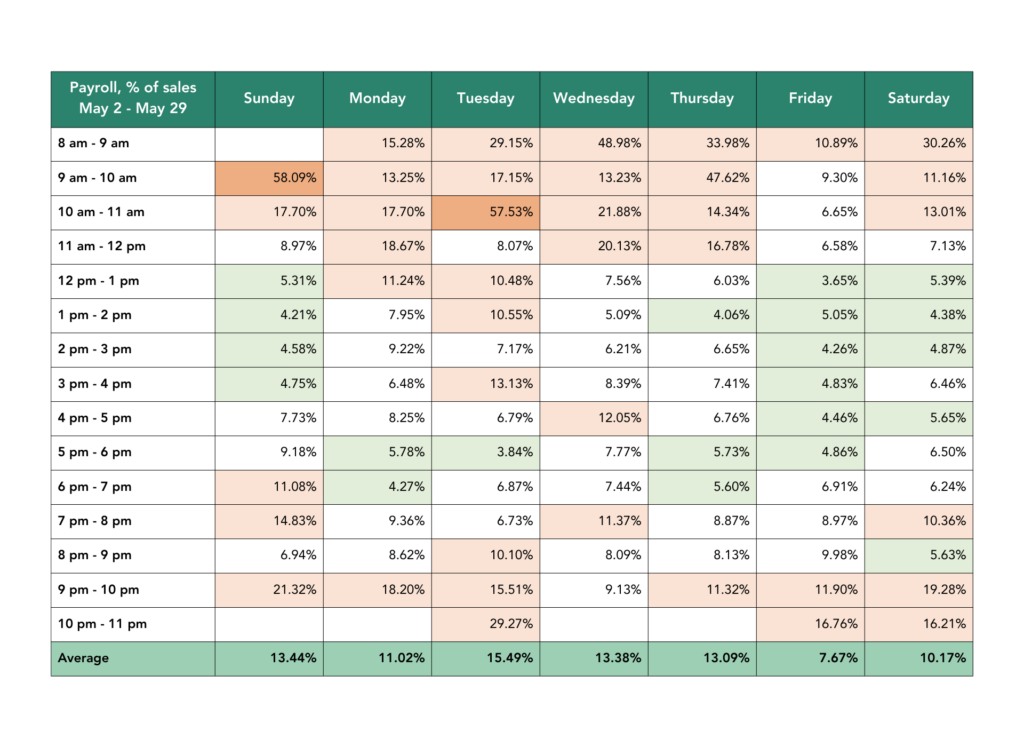

For example, here’s one of our clients prior to optimization. The table shows the daily cost of payroll as a percent of sales for each hour the dispensary was open. Green indicates high sales, which offset payroll costs resulting in a smaller percent. Orange indicates low sales and a resulting higher percentage. From here, it’s easy to see that this client should reduce the number of budtenders on Sunday from 9-10am and Tuesday from 10-11am when sales are low.

Quality of Labor

At GreenGrowth CPAS we advise our clients that the quality of labor is even more important than the quantity of labor. One of the key factors in optimizing payroll for cannabis businesses is evaluating the performance of budtenders. This can be done by analyzing each budtenders average ticket sales and the ratio of total sales versus hours worked. Budtenders with a high performance ratio should be identified and can be utilized to train and write scripts for the rest of the team. Doing so leads to increased sales and customer satisfaction, because it improves the overall quality of budtenders. Ultimately, optimizing budtender performance can lead to greater efficiency and profitability for the cannabis business.

Want to Learn More?

As the cannabis industry continues to grow, payroll optimization is becoming increasingly important for businesses operating in this space. We have saved our clients on average $20K-$30K on each location just by helping them make these adjustments. If you’re unsure how to prepare or analyze any of the reports mentioned above, GreenGrowth CPAs can help! Contact us to learn more about our payroll optimization services for cannabis businesses.

We employ several financial programs to assist the company with its fiscal responsibilities, including tax planning and compliance, accounting & finance support, audit preparation, tax controversy support, and much more.