As cannabis markets continue to mature and legalization expands around the country, there will be a point where sales growth is no longer parabolic and operators will need to prioritize cash resources to survive. Operating costs continue to increase as business owners spend more than ever before on labor wages, marketing efforts, and other daily inputs due to inflation and a struggling workforce.

This article provides suggestions for operators needing to prioritize and increase cash flow to sustain their business during challenging market fluctuations.

Oklahoma cannabis market as a case-in-point

As a leading service provider to the cannabis industry in Oklahoma, we can attest to the potential, and difficulties facing cannabis operators in that market. According to the New York Times, Oklahoma has become one of the most accessible places to launch a cannabis business in the US. And Oklahoma has more retail cannabis locations than Colorado, Oregon, and Washington combined.

However, the market in Oklahoma has recently taken a large downturn. In the first 18 months of a legal market, dispensary revenues grew dramatically, then flattened out. Today, sales per location rates are dropping at a dangerous rate.

Many Oklahoma operators are banking on the recreational market will come to fruition and sales will triple overnight. At the same time, others are burning through cash just to stay alive in the once-booming market.

In the following, we’ll dive into steps cannabis operators in EVERY market can consider to prioritize cash resources when business is starting to slow and it is time to tighten your belt.

What to consider before developing a cash flow plan

What is the stage of your business?

During the startup phase, it’s normal to see negative operating and investing cash flows and favorable financing cash flows. You may even see the first few years with operating losses that result in negative cash flows while your business experiences continued expenses and little revenue.

However, if you’re in the growth or a later phase and considered a mature cannabis business, cash flow issues need to be examined in detail. It’s essential to analyze the gravity of your situation and work out your cash flow accordingly.

How bad is the problem?

What is the reality of the situation? Are you bleeding cash, or are you hemorrhaging funds? Is it so bad that you need to look into a business sale or scale down your operation? Or are you in a good position but just need some business guidance on the next steps? Either way, our accounting experts can analyze your financial condition to provide recommendations on how to improve your fiscal position.

Remember to be honest with yourself, your team, and your investors. Optimism is great, but delusional optimism is deadly.

Developing a cash flow plan

How to prioritize cash resources for expenses

If you believe your financial problems are fixable, then it’s imperative to review how to utilize your cash on hand. Below we have suggested a framework around expenses to prioritize potential opportunities to improve your cash flow.

If you need help managing your cash flow, reach out to us for information on our Outsourced CFO services.

Priority #1: Allocating for Upcoming Taxes

We recommend never using tax money as operating capital. You run the risk of not making enough money back in time to pay your taxes and can ultimately end up in a significantly worse position.

There can also be huge penalties and interest assessed to operators for late or missed payments. In states like California, operators face penalties and fines as high as 50% of the original tax bill. Criminal charges of drug trafficking can even be brought up against operators for non-payment of taxes.

As a precaution, we recommend asking for and retaining receipts for all taxes paid, especially when paying an outside distributor or someone who is not a government entity. For example, in California, cultivation tax is paid to distributors, and therefore to keep adequate records, operators should be collecting receipts from each distributor.

Priority #2: Payroll

Cannabis companies succeed when their team is aligned and enthusiastic about working together to further the mission. The fastest way to destroy that team spirit is to not pay your employees.

Even by a day, one missed payroll period could motivate employees to look elsewhere for employment … and will almost certainly build resentment among staff.

Priority #3: Secured Debts

Many cannabis operators purchase equipment and other significant building expenses using secured debt. Under this method, if you miss a payment, you risk losing the income-producing asset you need to operate your business.

Examples include your extraction equipment, the mortgage on the property, and even financing for grow equipment.

Priority #4: Rent/Utilities

Next, make sure you can still afford to keep payments current on your space, as well as the vital utilities that keep your business open and operating. Licenses are often tied to addresses, and late or missed payments on rental agreement contracts can be egregious, which is why we always recommend making rent payments on time as agreed to in your contract.

If you have a good relationship with your landlord, consider reaching out to develop alternative ways to delay payments or offset costs by offering some other type of consideration, such as equity in the business.

For cultivators, missing utility payments can cause a hiccup in service, which could ruin your harvest or increase rates/deposits going forward. If the debt is high enough, you could lose service entirely and have to pay the total amount owed before utility companies will reinstate your service.

Priority #5: Critical Vendors

Maintaining a good relationship with vendors is vital to keeping your operation stocked with the latest and most popular products. Late or partial payments can cause distributors to decline to work with your cannabis business in the future. While we always recommend staying current with all of your debts, be sure to prioritize vendors that you 100% depend on to stay in business.

Business owners talk to each other, and while you may think you can just work with another distributor, the word can quickly spread about your untimely payment history. Also, some distributors have exclusivity agreements with certain top-selling brands that cannot be purchased elsewhere.

Priority #6: Insurance

Because the industry is still so new, insurance contracts and stipulations should be reviewed on a case-by-case basis. You typically receive a grace period if you’re late on premiums in traditional sectors, but that may not be the case with your cannabis general liability, product, or vehicle insurance.

It’s crucial to know how late payments can affect business expenses and coverage. A lapse of insurance coverage can have many adverse effects on the sustainability of your venture. We advise our clients to stay up to date with all insurance premiums as they protect your business in the event of an emergency or other unforeseen incident.

Priority #7: Lower priority bills

- Non-critical, current invoices

- Unsecured debt & credit cards

- Be careful with your personal liability exposure. Missing payments damage the business and adversely impact your credit, preventing access to future borrowing needs and more.

- Rainy day fund

Cutting costs to boost cash resources

Now that we have covered how to prioritize your cash flow, let’s talk about how to reduce the amount of cash flow going out.

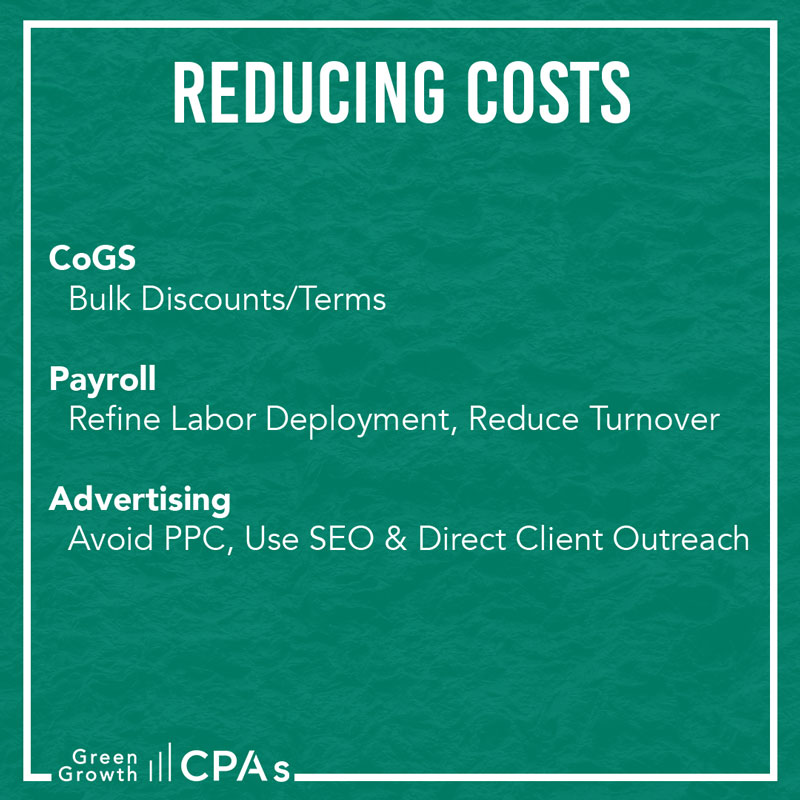

The three main areas we can often help clients save money and be more efficient with their funds include:

- cost of goods sold

- payroll

- advertising expenses

Cost of Goods Sold

By reaching out to vendors and negotiating terms, operators can save money by buying in bulk or spreading out payment terms. Reallocation of CoGS can also help to increase your leverage to buy more types of products.

- As an alternative to paying for all products upfront, try to negotiate to pay on units sold, not on units purchased. This way, if products are unpopular with your clientele, you can avoid paying for what’s not selling while still keeping your shelves stocked with merchandise.

Payroll Expenses

Here are four ways to consider saving costs:

- Option #1 – Review your labor deployment

- Option #2 – Reducing employee turnover can significantly reduce payroll costs

- The cannabis industry experiences about 40-60% employee turnover (in line with quick-service restaurants). The cost of employee turnover can range upwards of $5,000 per person in the quick-service sector. While sometimes turnover is necessary, excessive turnover eats away and increases overall costs.

- Option #3 – Offer a Commission Program

- An incentive program can often help drive revenue production and sales. For more information on a step-by-step process for creating a sales incentive program for your dispensary frontline staff, take a look at our YouTube video.

- Option #4 – Outsource your HR Operations

- Depending on your structure, outsourcing certain services could lower your costs and create a better employee experience improving employee retention rates.

Advertising Costs

While we understand you need to get the word out, attribution of marketing efforts are sometimes difficult to track. You risk spending money and being unclear about what’s actually helping you drive sales. And because of the adverse implications of 280E, it’s not a deductible expense, so it REALLY has to do wonders for your business.

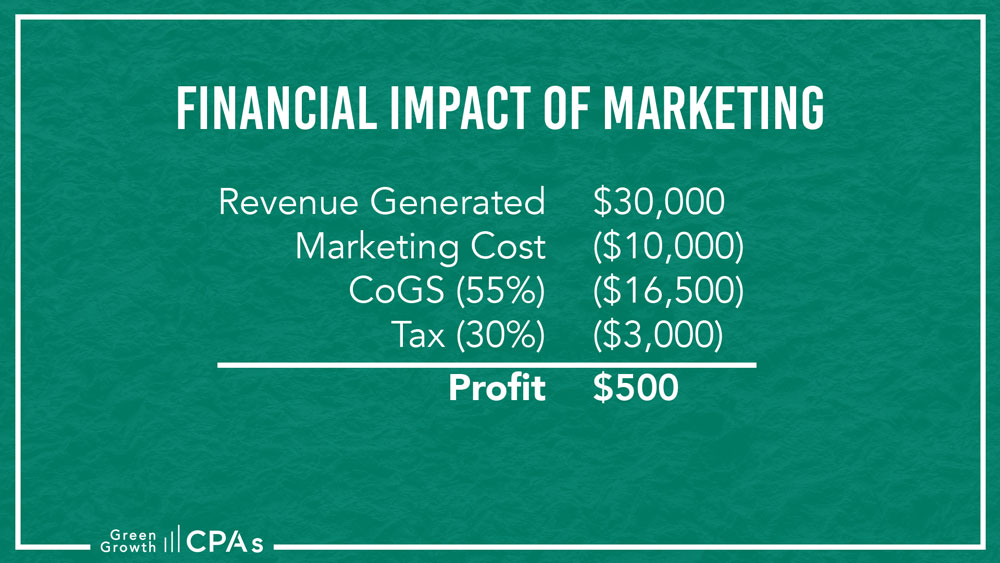

Let’s look at an example using Weedmaps, analyzing the advertising costs and profits.

- Say you spend $10,000 in ad cost to Weedmaps and it generates $30,000 in sales

- Your Gross Profit is 45%, leaving 55% as the costs which comes to $16,500 in CoGS

- Now, we must consider that you can’t write this marketing expense off and we will assume a 30% effective tax rate

- 30% x $10,000 comes to $3,000 in estimated tax liability

- In the end, even though you increased sales due to your advertising dollars spent, the margin is incredibly slim. In this example, the net profit equates to $500.

- $30,000-($10,000)-($16,500)-($3,000)

- While $30,000 in sales only amounted to $500 in profits, $50,000 in sales may be worth the expense. But once you stop paying, the faucet will stop producing.

Instead of pay-to-play marketing like Weedmaps, consider other alternatives such as:

- Build up local SEO so you have a durable presence online.

- Drive content marketing through social media and YouTube. You’re one post away from going viral!

- Reach out to clients directly via email marketing or SMS marketing. If it’s a slow day at the store, budtenders can send texts or calls to drive business. Come up with easy scripting to invite customers in to check out specials and new products in the store.

- Start a rewards program by leveraging sticky products for frequent customers to retain their return business. For example, once a customer spends $1,000 on product, they receive a $25 discount on their next order.

Final thoughts on prioritizing cash resources

If you would like help prioritizing cash flow resources for your cannabis business, we can help. For more information on how POS data analytics tools can help your cannabis dispensary, reach out to our accounting experts at GreenGrowth CPAs.

We are here to help your cannabis venture through any level of the accounting and tax filing process. We employ several financial programs that can assist the company with its fiscal responsibilities including, tax planning and compliance, outsourced CFO support, audit preparation, tax controversy support, and much more.

For recommendations and assistance with tax planning and accounting services, schedule a free consultation or contact us at 1-800-674-9050.