As the cannabis industry attracts more entrepreneurs, those same people are looking to raise capital.

In this blog post, we will walk you through four main points on preparing yourself to speak and collaborate with investors.

These topics include:

- Cannabis Industry Context

- Raising Capital

- Pitching Your Business

- Negotiating Your Deal

Cannabis Industry Context

Let’s discuss the mindset you need to have and understanding the landscape that you will be competing in as a cannabis entrepreneur.

First, it’s imperative that you know that it will take A LOT of money to create a successful cannabis business for a few reasons.

It’s a highly regulated industry, just like the liquor business or airlines. That means a lot of compliance related issues that you will need to hire experienced professionals to manage for you such as lawyers to handle licensing and CPAs to handle your taxes.

Most businesses fail because they run out of cash…plain and simple. Whether that’s cash for payroll, to solve marketing problems, or to solve legal issues; without it, you have no oxygen for your business.

Next, running a cannabis business, especially a dispensary is an incredibly hard daily operation. You are running a public-facing pharmacy that is helping patients and legal adults learn and obtain their cannabis. It takes a high-level of skill and tolerance to work with the public day in and day out. It could be 8, 12, maybe even 18 hours days to make sure your operation is running smoothly.

Another point that we need to stress is that you can’t do it all by yourself. You need to build a team to over all of the main functions of your business; especially the ones you don’t like to do.

We suggest starting to look for people to cover:

- Human Resources (hiring/firing/compensation/etc…)

- Finance/Accounting

- Technology

- Legal

- Purchasing/QA

- Operations

You also need to surround yourself with smart, trusted advisors that can help make up your board of directors once you get that far. Start now, because building a network and trust between people does not happen overnight.

Raising Capital

Let’s start with a 30,000 foot look at the entire process.

Putting on the capital-raising roadshow is a long and tiring process, so be prepared to focus solely on this until it’s complete.

And don’t clap for yourself too much once you do raise the money. Raising capital is just one check box, one step in the entire scheme of building a business. Yes, it’s a gate, but the execution of your plans, finding product market fit, and creating value is most important. When you get the money, the clock starts ticking, so don’t let that time pass too fast.

Taking money from investors at any level is like a marriage but with more demanding contracts and strict controls on your actions. You’re attached to these people for life or until you sell your business, buy them out, or fail in your business.

But one thing to understand is that investors are betting on the jockey, not the horse. This means they are betting on you and your team to determine the best way to execute your plans. They are investing in a relationship because, to be quite honest, opening a cannabis dispensary is not that novel of an idea.

One piece of advice is to be honest with what you don’t know and ask for help from investors when needed. They are vested in your success, and you already got the check, so there is no need to worry about scaring them off. Further, don’t let pride hold you back from success, and be open to feedback.

It’s also important to know that institutional investors are guessing when placing their money. Investors don’t know how everything will play out, but they are making many bets. They know that one homerun will pay off the 47 strikeouts to 0.

Lastly, don’t think you’re their only option to enter the industry. Investors have many opportunities to get exposure to the cannabis industry, including investing in companies like yours, into stocks of larger companies, or even contributing to larger funds that place bets for them. Stay humble.

Knowing there are many options, you should consider what makes you unique. Ask yourself:

What leverage do you have in the conversation with investors that makes you desirable?

- Is it experience or education in the industry?

- How about traction on a small scale that’s ready to go big?

- What about influence in your community where you have a built-in user base once you launch?

- Or maybe you are putting some of your own cash in, so there’s a vested financial interest not to let this fail.

Types of Investments

There are many ways to raise capital for your cannabis business, and those are:

- Self-Funding: You can put your liquid cash into the business, borrow out of your 401k, borrow against your home value, or sell high-value assets

- Friends and Family: Taking cash or investments from your close friends or family.

- Angel Investors: These are usually $100-500k rounds from wealthy professionals such as doctors, lawyers, or even generational wealth families.

- Private Equity or Venture Capital: More common as time goes on, and this is where very high-growth businesses need to look for capital.

Traditional Fundraising Journey

Now let’s explore the stages of a typical investment journey.

It is highly recommended that you self-fund to start, but if you can’t, then it’s time to look elsewhere.

First is friends and family. These are usually smaller and easier to close, and the terms should be simple and favorable for them to get in on the next round.

Then you have Series A, which should be someone local who understands the context of your market. These should also be relatively easy, especially if you have some traction. At this stage, valuation is not everything. It would be best if you also saw what smart money you are aligning yourself with, and we will get to that later.

Then you have Series B, which is usually some of the most challenging money to raise, and it takes time and lots of patience. It’s hard because investors will continue to ask, why are you, not cash flow positive yet? It doesn’t take a hero to lose money every month, but a savvy operator takes cash and turns it into long-term value.

Finally, you have Series C and beyond. This is all about traction and product market fit. Usually, you’re going out to raise this round because there is fierce competition between you and other brands, and the person with the most significant war chest (and great deployment of capital) will likely come out on top.

Another potential capital raise is a Line of Credit (LOC), mainly non-dilutive capital collateralized by your assets such as Accounts Receivable. You may see these, also called bridge loans.

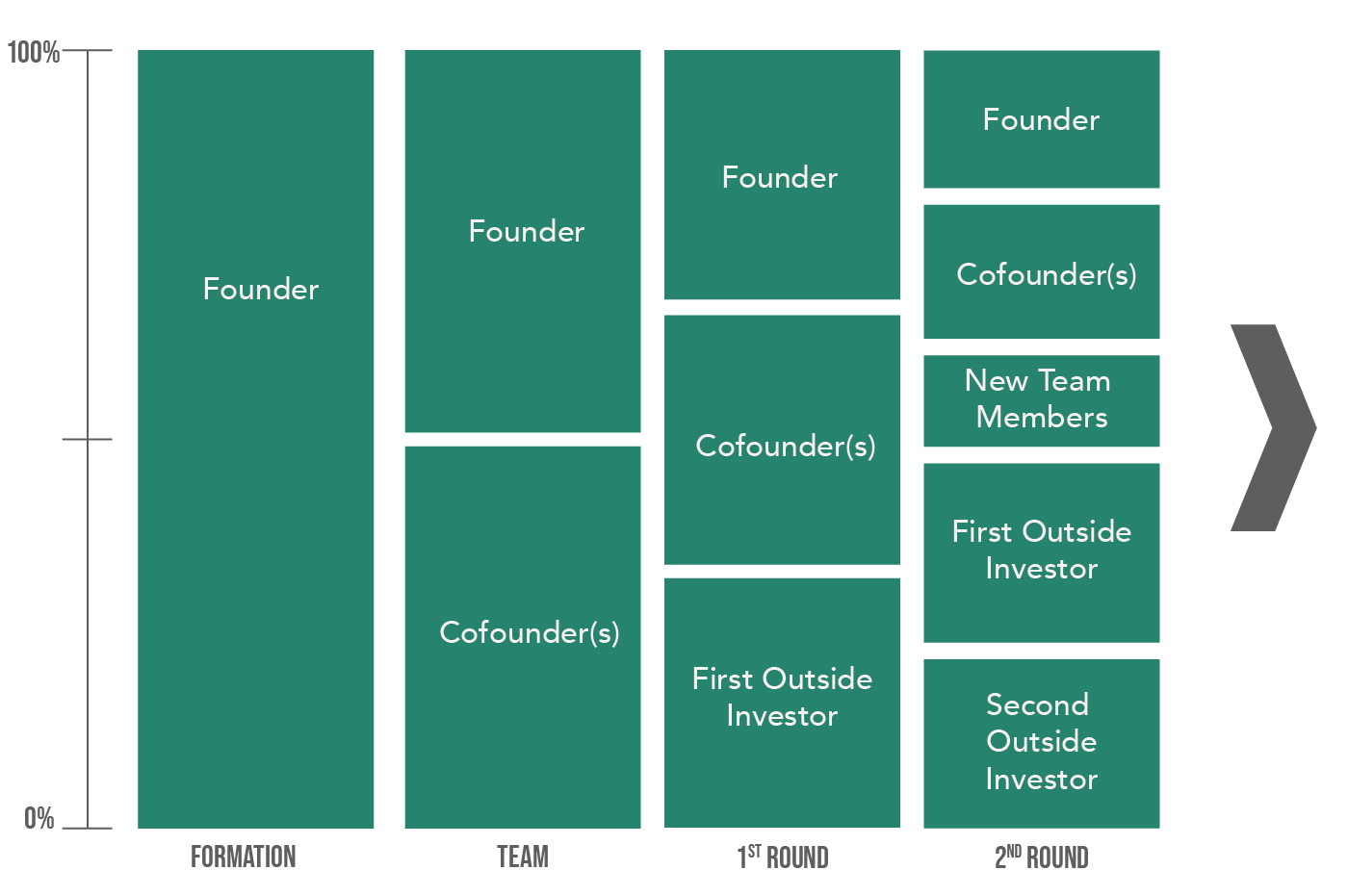

Above is an illustration that shows how the capitalization table changes over the different parts of your fundraising journey.

As you can see, your business formation starts with you owning everything. Then as you build your team, you need to split things reasonably.

As you start to take on capital, you need to break off equity for your outside investors if you’re not self-funding your business. And with each successive round of raising money or hiring new key team members, you continue to get diluted down and own less and less equity than when you started.

It’s important to know that you won’t always own a huge chunk of your business (or maybe you will), but you give up equity in exchange for capital that helps you make your company more valuable. While your percent ownership may decrease, your total value could (and should) increase over time.

Understanding the Financials of This Transaction

Before you take on capital, you need to run the numbers to see if you like the position you’re putting yourself in.

You will need to do a financial analysis and produce Pro Forma financial statements, which will help you quantify how much capital you need and how you will use those funds. It also enables you to answer the question: Does taking on capital even make financial sense? Some businesses raise too much money and give away too big of a chunk of the business only to lose their motivation for growing the company.

Once you know more about the financial nuts and bolts of the capital raise, you then need to look at your exit potential. What can you get?

In the dispensary market and cannabis industry, we see multiples land everywhere from 2x to 12x, but more toward the 3x for dispensaries. But note, more and more dispensaries are opening every month, eventually driving these multiple down.

The multiples are typically based on Net Income instead of gross because of the extreme tax burdens that cannabis companies have. If you don’t have a good 280e mitigation strategy, you will surely see a lower valuation compared to someone with an offensive tax strategy.

Once you know the total exit value, you need to factor in your exit percentage.

Let’s look at an example.

Gross Revenue = $2.5MM

CoGS = $1.5MM

Gross Revenue/Margin = $1MM/40%

Additional Expenses and Taxes = $725,000

Net Income = $275,000

Multiple = 4x

Total Business Value = $1.1MM

Your ownership = 51%

You get $561,000 at the sale of the business.

Smart Money vs. Dumb Money

You may have heard of smart and dumb money, but let’s dive into the distinction.

Smart money is someone who brings you more than just cash. You need to ask yourself, if I take money from this person, WHAT ELSE can they offer or provide to me and my business?

Some examples include:

- Access to joint venture deals with their other portfolio companies

- Professional services

- Mentoring/coaching/wisdom

- Access to people, markets, and other important business components

Dumb money is simply someone who can write you a check but provide little to nothing other than a headache when they keep asking you when they will be getting their return on their investment.

But dumb money can be smart if you know what to execute precisely at a high level, and they give you the space you need to grow your business.

It’s a balance, but we suggest always going for smart money, especially in cannabis. It’s quite a clicky industry, and you need someone to be your evangelist to get you into the inner circles.

Aspects of Predatory Financing and Investing

One thing you often see in the cannabis industry is predatory financing or investing, where more sophisticated investors take advantage of desperate startup founders.

While most of these tactics are not illegal, they can surely screw you over in the long-term, so you need to keep your eyes open for the following tactics.

- Big fees for negotiating of closing deals. Some people out there want to take on enormous fees for no logical reason, so make sure to quantify and cap fees if you start to see them.

- Penalties for paying off debt early or selling your company before a certain time. If you take on debt financing, you should ensure you have the freedom to pay it off early with no penalties. Also, make sure you are not subject to an egregious lockup period.

- Inflated Interest Rates. If someone is loaning you cash at some crazy interest rate (practically loan-sharking), then turn around and run the other way.

- Steering/targeting. If someone is trying to steer you into a deal or targeting you with options that don’t make financial sense for you or the business, don’t work with that person. Again, you become married to investors and don’t want to work with someone who doesn’t have your best interest as a consideration.

- Adjustable interest rates that explode. Look at your deal terms and see if there is anything around adjusting interest rates, what triggers the adjustment, and what level they go to. If it’s something crazy high, negotiate them down or entirely remove them from the deal.

- Mandatory arbitration clauses. Don’t let someone take away your power to use the full extent of the legal system against them. If someone is forcing arbitration on you with no ability to sue, you will lose access to legal tools to protect your business and personal property.

- Hush side deals or side deals in general. In the social equity space, you sometimes see investors paper a good value for ‘looks’ to the DCR but then insist you sign other paperwork to manipulate the numbers. This differs from an amendment and could hurt you financially if you need to know what they’re making you sign. Always consult your lawyer before making or signing any deals.