The cannabis industry has experienced unprecedented growth in recent years, with the legal market expanding as regulatory changes take place. The demand for cannabis products is soaring, but supply often fails to meet the market requirements. This presents a lucrative opportunity for potential cannabis investors. However, it is crucial to recognize that the industry is still in its early stages of development, with significant growth potential ahead.

Explosive Growth and Economic Impact

The cannabis industry has witnessed exponential growth, with its economic impact reaching billions of dollars. In 2025, the economic impact of the U.S. legal cannabis industry is expected to hit $123.6 billion, reflecting its rapid maturation and expanding contribution to jobs, tax revenue, and market growth.

Market Maturity and Investor Advantage

As the cannabis market matures, it is favoring well-funded and sophisticated organizations. In the early stages, the industry was dominated by local and small businesses facing legal uncertainties. However, larger investors have gained an upper hand as stability and regulations have improved. Private capital is crucial in funding cannabis businesses since traditional lenders are hesitant to provide loans due to federal restrictions. Investing in cannabis offers a unique opportunity for substantial return on investment (ROI), given the industry’s consistent growth and diminishing uncertainties.

ROI Strategies for Cannabis Investors

When investing in the cannabis industry, there are various strategies to consider, depending on your goals and risk tolerance. Here are two common investment angles that can lead to maximum ROI.

Investment Angle 1: Build and Sell Before Operation

This strategy involves building a cannabis business from scratch and selling it before it becomes operational. By securing early licensing, approvals, and organizational structure, you can add value to the investment. The key is to craft a marketable business that is ready to enter the broader market quickly. Investors who adopt this angle capitalize on the premium that well-funded buyers are willing to pay for a business that can swiftly enter the market.

Investment Angle 2: Build and Operate for Long-Term Profitability

Alternatively, you can choose to take a cannabis business through to operation and focus on long-term profitability. By investing in the development and operation of a business, you provide stability and resources for the business to thrive. This strategy requires partnering with a reliable operating partner and leveraging their expertise to maximize profits. The value of the investment lies in the successful operation of the business and its ability to generate sustainable returns over time.

Milestones and Timelines for ROI

Understanding the key milestones in the development of a cannabis business is crucial for maximizing ROI. Each milestone represents a significant increase in the value of the investment. Let’s explore some of the major milestones and their impact on ROI.

Green Zoned Property

Securing green-zoned real estate approved by local authorities for cannabis use, significantly increases its value. This milestone can lead to a 100-125% increase in the property’s worth. The value varies depending on the type of cannabis business and its location.

Land Entitlement and Conditional Use Permit (CUP)

Obtaining a CUP allows for the specific usage of the property for cannabis-related activities. This milestone removes political opposition and increases the value of the investment by another 125-200%. It demonstrates the business’s legitimacy and paves the way for further development.

State Licensing

State licensing is a crucial step in the cannabis business’s journey. While obtaining licenses incurs costs, the value they add to the investment far outweighs the expenses. State licenses can increase the value of the business by $100,000 to $300,000, depending on the demand and location.

Facility Setup and Improvements

Investing in the infrastructure and facilities necessary for the business’s operation adds value to the investment. The impact on ROI varies depending on the type of activity and the extent of the improvements made. For instance, retail businesses may experience smaller increases in value, while processing facilities with complex infrastructure can see substantial value appreciation.

Certificate of Occupancy

Obtaining a certificate of occupancy signifies that the business is ready to operate and enter the broader market. At this stage, the value of the investment is not merely speculative; it is based on the business’s actual value and revenue-generating potential.

Managing Risks in Cannabis Investments

Investing in the cannabis industry comes with its own risks, and adopting a proactive approach is crucial. Here are some key risks to consider and strategies to manage them effectively.

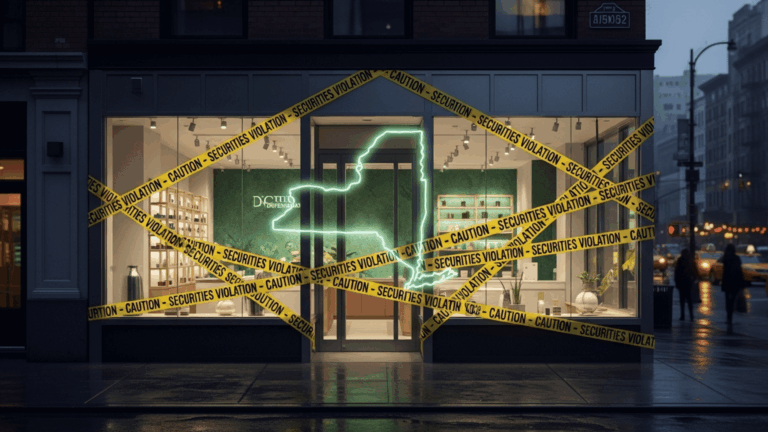

Regulatory Uncertainties and Compliance

The cannabis industry operates in a complex regulatory landscape at the state and federal level. Federal prohibition poses a significant risk, as the federal government can seize assets related to cannabis businesses. It is essential to stay updated on the legal landscape, focus on compliance, and work with experts well-versed in cannabis regulations to reduce this risk.

Market Competition

As the cannabis industry matures, competition increases. New businesses enter the market, necessitating existing companies to adapt their business models and pricing strategies. Analyzing the competitive advantage of your potential investment is crucial. Factors such as intellectual property, technology, and proprietary processes can provide a long-term competitive edge.

Future Legislative Changes

The cannabis industry is subject to evolving legislation. Changes in laws and regulations can significantly impact the operations and profitability of cannabis businesses. When evaluating investment opportunities, consider the company’s legal strategy and future plans to ensure it can adapt to new legislation effectively.

Analyzing ROI and Market Trends

Analyzing the potential ROI of cannabis investments can be challenging due to the industry’s relative immaturity. However, by conducting due diligence and evaluating key factors, you can make informed investment decisions. Consider the following when assessing ROI:

Viability of the Investment

Evaluate the problem the business solves and its relevance in the market. Assess the team’s expertise, competitive advantage, traction, and capital structure to gauge the investment’s viability.

External Factors and Market Volatility

Understand how external factors, such as regulations and market trends, can impact the investment. While the cannabis market offers significant growth potential, it is essential to consider its volatility and anticipate potential risks.

Diversification and Investment Opportunities

Consider diversifying your investment portfolio within the cannabis sector. Look beyond direct involvement in cannabis operations and explore support services, pharmaceutical companies developing cannabinoid-based drugs, and product providers venturing into the cannabis market.

If you feel that investing directly into a cannabis company is too high a risk for you, consider investing in a company in a related sector to start.

Some other sectors related to cannabis that are seeing growth and activity are:

- Agricultural Technology

- Organic Farming

- Industrial Hemp

- Biotechnology

- Cultivation and Retail

- Ancillary products and services

- Consulting Services

- Holding Companies

- Cannabis Products and Extracts

Conclusion

Investing in the cannabis industry can yield impressive ROI if approached strategically and with a thorough understanding of the risks involved. You can maximize your returns and capitalize on the industry’s growth by conducting due diligence, recognizing key milestones, and staying informed about market trends. Remember to seek professional advice, stay compliant with regulations, and adapt to evolving legislation to safeguard your investments. With careful consideration and proactive management, the cannabis industry holds significant potential for profitable investments.