Starting a Cannabis Business in Minnesota: Licensing, Costs, and Compliance

Minnesota’s cannabis industry is set to expand in 2025, offering new opportunities for entrepreneurs. However, starting a cannabis business in Minnesota involves strict licensing requirements, significant startup costs, and complex compliance measures. Without proper planning, operators risk delays, financial losses, or legal setbacks.

If you are considering launching a dispensary, cultivation facility, processing business, or delivery service, understanding Minnesota’s cannabis licensing process, tax obligations, and operational costs is essential. This guide outlines the key steps to successfully start a cannabis business in Minnesota.

Minnesota Cannabis Business Licensing Process: What You Need to Know

Minnesota’s cannabis regulations are overseen by the Office of Cannabis Management (OCM). The application process is competitive, requiring businesses to meet strict qualifications.

Types of Cannabis Licenses in Minnesota

Minnesota offers multiple cannabis license categories, including:

- Retail Dispensary License – Allows businesses to sell cannabis products to consumers.

- Cultivation License – Permits the growing and harvesting of cannabis for commercial sale.

- Processing License – Covers the manufacturing and extraction of cannabis products.

- Microbusiness License – Enables small-scale businesses to cultivate, process, and sell products under one license.

- Delivery License – Allows businesses to legally transport cannabis products to consumers.

Eligibility and Requirements

To qualify for a cannabis license in Minnesota, applicants must:

- Demonstrate financial stability with proof of capital and an operational budget.

- Pass background checks with no disqualifying criminal history.

- Secure a compliant business location with zoning and property approval.

- Submit a comprehensive business plan, including security, operations, and compliance strategies.

Cannabis Business Costs: What to Expect in Minnesota

Starting a cannabis business requires a significant financial investment. Costs vary based on location, business type, and operational scale.

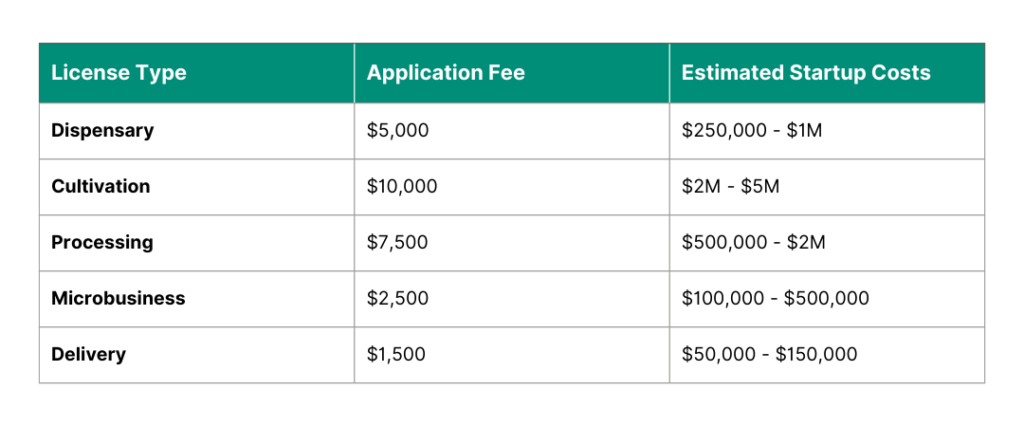

Estimated Startup Costs by License Type

Additional Business Costs

- Real estate and lease agreements

- Security systems and compliance measures

- Employee wages and training

- Inventory and equipment costs

- Legal and accounting fees

Minnesota Cannabis Compliance and Taxation Requirements

Minnesota cannabis businesses must comply with state and federal regulations, including IRS 280E tax restrictions, which prevent standard business deductions.

Tax Considerations for Minnesota Cannabis Businesses

- State Cannabis Excise Tax: Minnesota imposes a cannabis excise tax in addition to standard sales tax.

- 280E Tax Law: Cannabis businesses cannot deduct standard operating expenses at the federal level.

- Cost of Goods Sold (COGS) Strategy: Maximizing COGS deductions is crucial for reducing taxable income.

Compliance Requirements

- Metric Tracking Compliance: Businesses must use the state’s seed-to-sale tracking system.

- Security and Surveillance Protocols: Strict security requirements, including 24/7 video monitoring.

- Packaging and Labeling Rules: All products must meet state labeling guidelines and child-resistant packaging standards.

- Banking Limitations: Due to federal restrictions, cannabis businesses face challenges with traditional banking.

Frequently Asked Questions About Starting a Cannabis Business in Minnesota

How much does it cost to open a dispensary in Minnesota?

To open a dispensary in Minnesota in 2025, cannabis retailers are required to pay three nonrefundable fees to the Office of Cannabis Management (OCM) at different stages of their business:

- Application fee: $2,500

- Initial license fee: $2,500

- Renewal license fee: $5,000

Additionally, startup costs, real estate, security systems, and inventory expenses should be factored into the total investment required.

How long does it take to get a cannabis license in Minnesota?

The application process can take six to twelve months, depending on demand and regulatory approvals.

Can I apply for multiple cannabis licenses in Minnesota?

Yes, but businesses must meet strict financial and operational requirements for each license type.

Do I need an accountant for my cannabis business?

Managing finances in the cannabis industry is uniquely complex due to evolving regulations, strict compliance requirements, and tax laws. A cannabis-specialized CPA ensures your business remains compliant, optimizes tax strategies to reduce liabilities, and prepares accurate financial records for audits. Having expert financial guidance can help prevent costly mistakes and position your business for long-term success.

Setting Your Minnesota Cannabis Business Up for Success

Starting a cannabis business requires careful planning, financial investment, and compliance with licensing regulations. With high startup costs, tax challenges, and evolving laws, working with industry experts can help you avoid costly mistakes.

Need expert guidance on licensing, taxes, or compliance? GreenGrowth CPAs specializes in helping cannabis businesses in Minnesota navigate financial challenges and regulatory hurdles.

Schedule a Free Consultation today to ensure your business is financially and legally prepared for Minnesota’s cannabis market in 2025.