Building on our previous insights about the FinCEN BOI Update, we recognize 2024 as a pivotal year for US businesses in terms of compliance. While not offering direct BOI filing services, at GreenGrowth CPAs, we aim to share all the information needed on how to file, ensuring that entities are well-equipped to navigate the complexities of the new BOI reporting standards.

This guide provides a practical blueprint for the BOI filing process ensuring adherence to business regulation standards and enhancing financial transparency practices.

Initiating Compliance: Securing a FinCEN ID

The journey to meticulous reporting begins with obtaining a FinCEN ID. This is a vital step, especially for those with interests in multiple entities. Here’s a breakdown of the process:

Accessing the Application

Start by visiting the FinCEN ID Application for Individuals. You’ll need a login.gov account with two-factor authentication (2FA) to access the application, ensuring a secure entry into the system for secure business reporting.

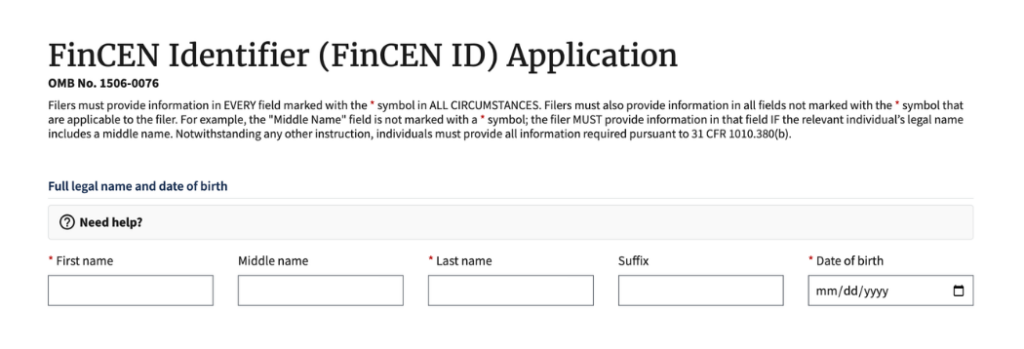

Inputting Personal Information

Enter your full legal name and date of birth. This step sets the foundation for your unique identification.

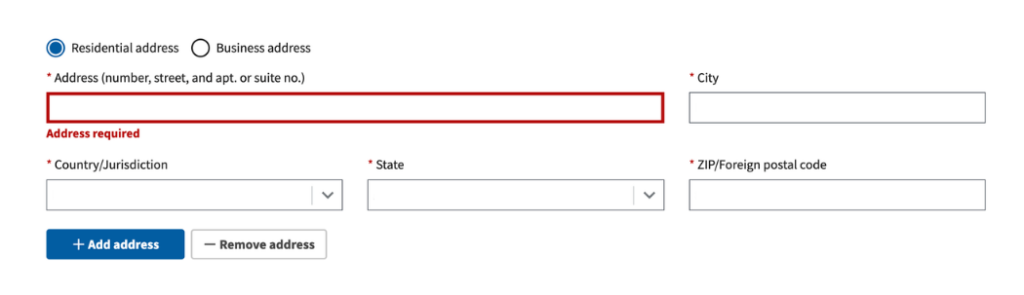

Providing Your Address

Next, you’ll need to specify your address, forming another critical component of your identity for the FinCEN ID.

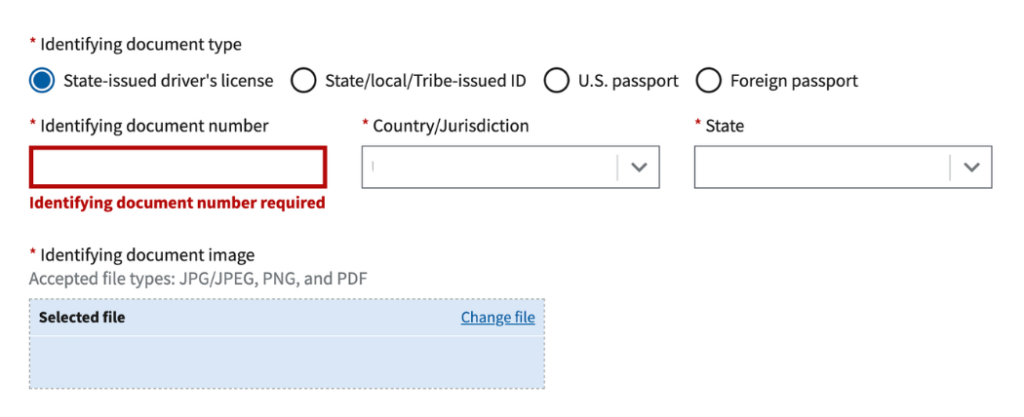

Uploading Identifying Documents

Choose an identifying document – many prefer a U.S. passport for its extended validity, but other forms like a driver’s license are also accepted. Attach an image of the chosen document for verification purposes in the FinCEN reporting requirements.

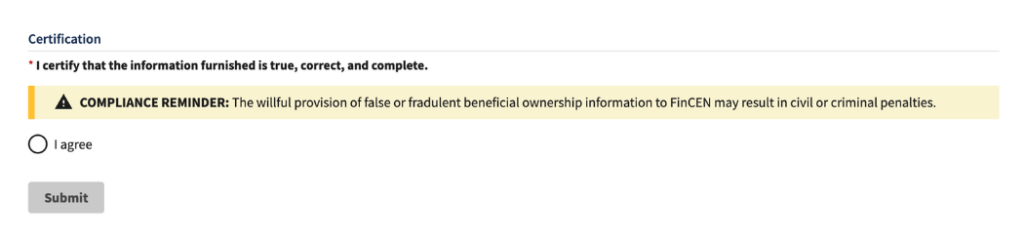

Certifying Information Accuracy

The final step involves certifying that the information provided is true and complete. Note the severe legal implications for providing false or fraudulent information.

Once submitted, the process to receive a FinCEN ID is swift, often taking less than 10 minutes. Remember that each individual must secure their own FinCEN ID, as the system is not designed for third-party preparers.

The BOI E-Filing System: A User-Friendly Approach to Compliance

Filing the BOI Report (BOIR) is made straightforward through the BOI E-Filing System. This system contrasts with the FinCEN ID system by not requiring a login, simplifying access. Here’s what you need to know:

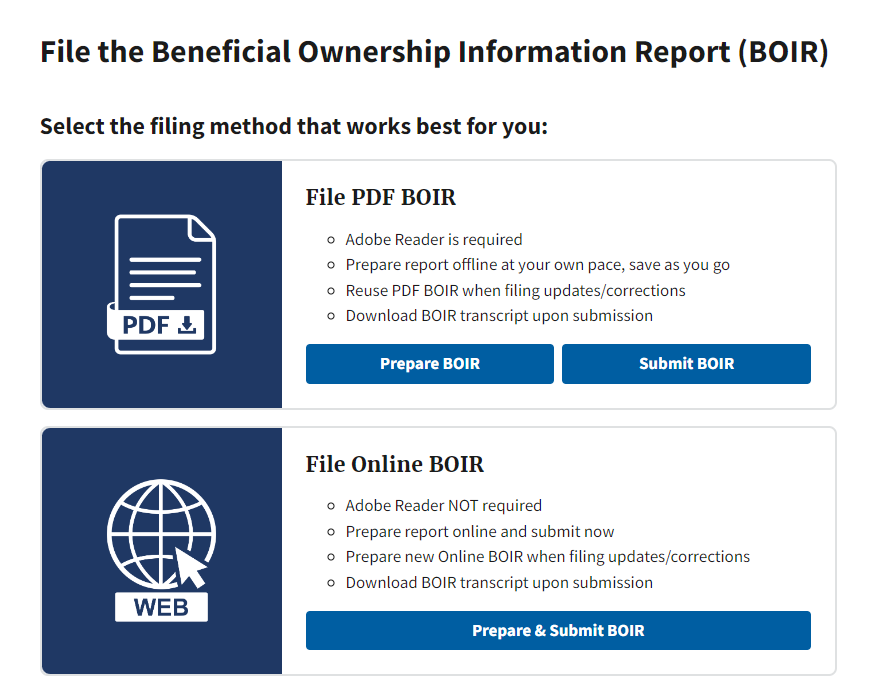

Choosing the Filing Method

The system offers two options – the familiar PDF upload or the more streamlined online system, demonstrating financial regulatory updates in action.

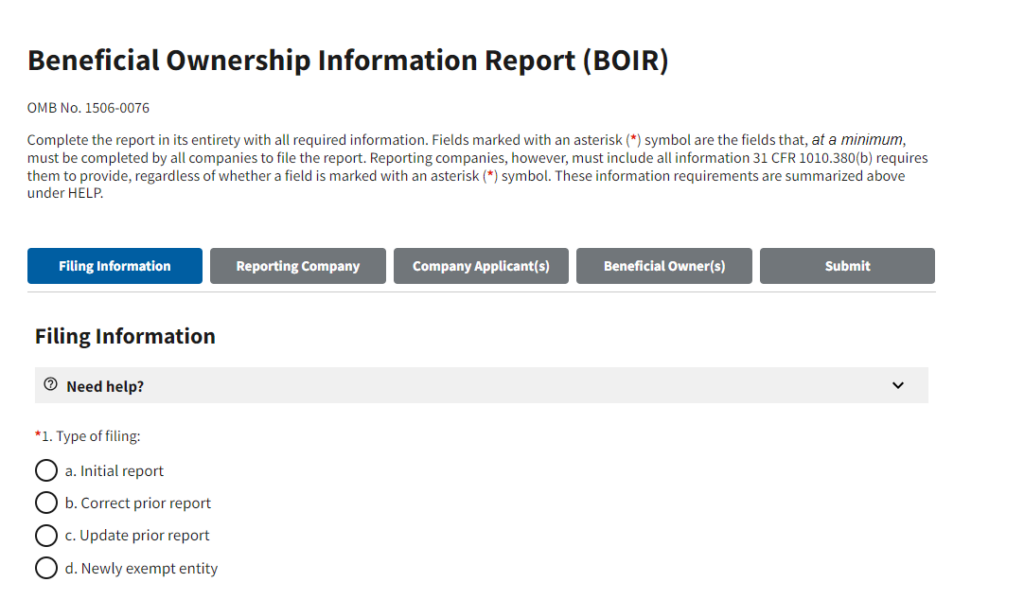

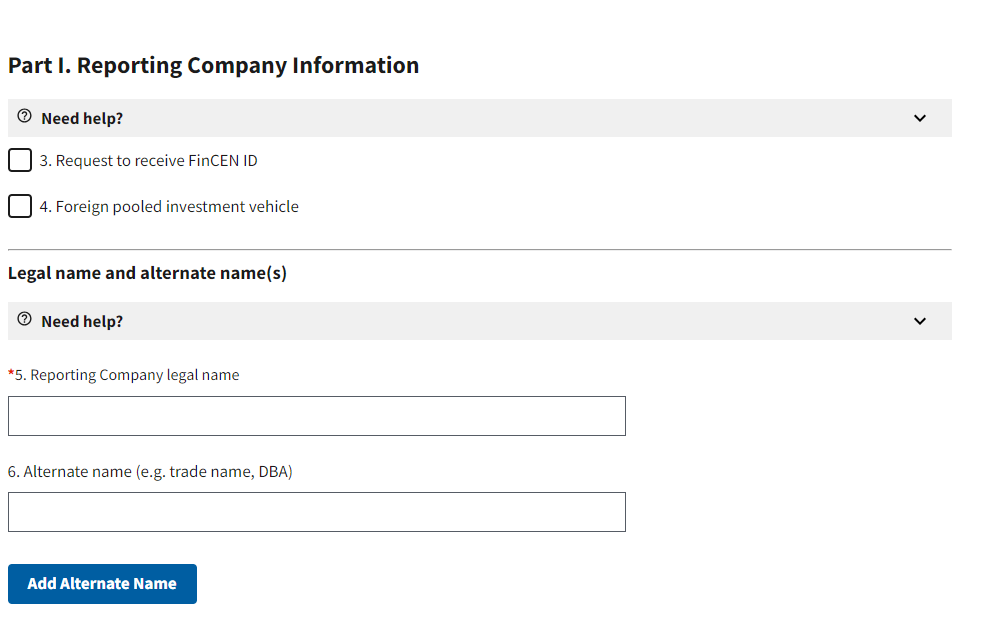

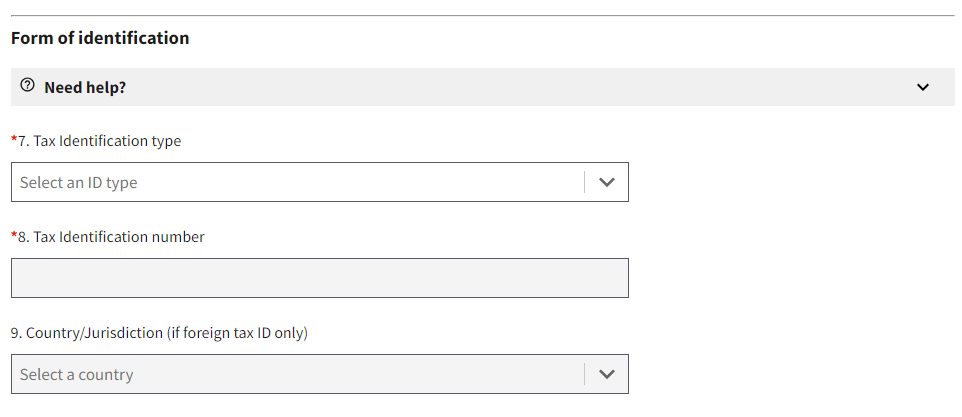

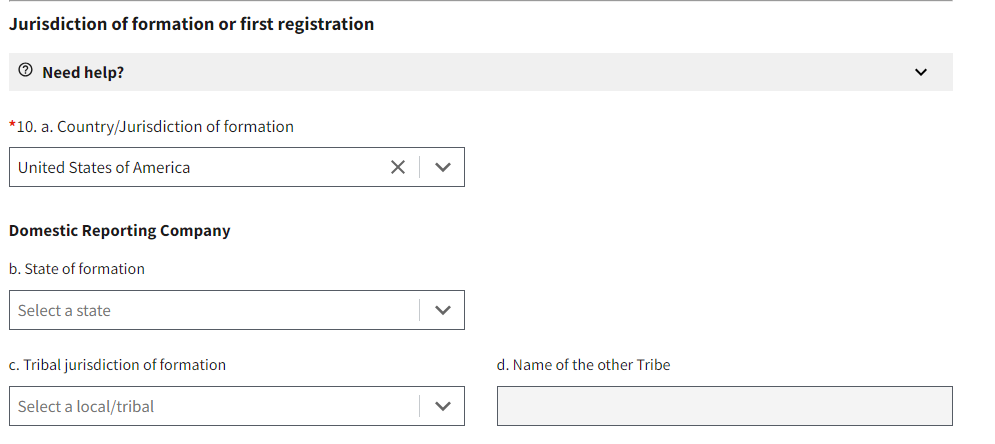

Entering Company Details

Begin by selecting the report type and entering the preparation date. The reporting company must provide comprehensive information, including tax identification numbers and formation jurisdictions. If applicable, you can request a FinCEN ID for the company and add a trade name or DBA (Doing Business As).

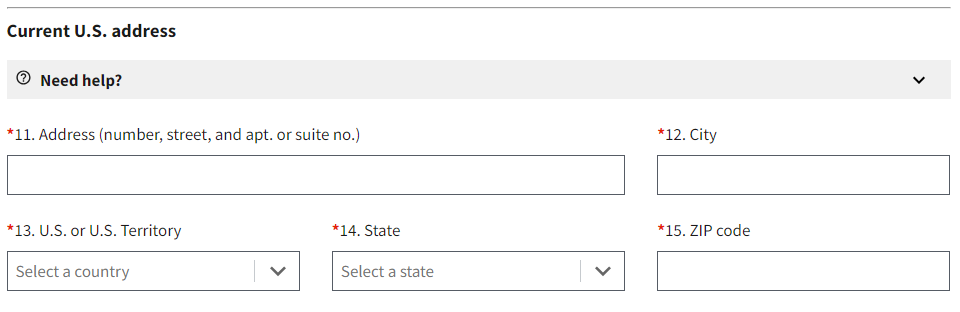

Disclosing Company Applicant(s)

For entities formed before January 1, 2024, you can bypass this step by checking the appropriate box. Otherwise, disclose the individual or firm responsible for the entity’s formation, emphasizing the corporate accountability insights.

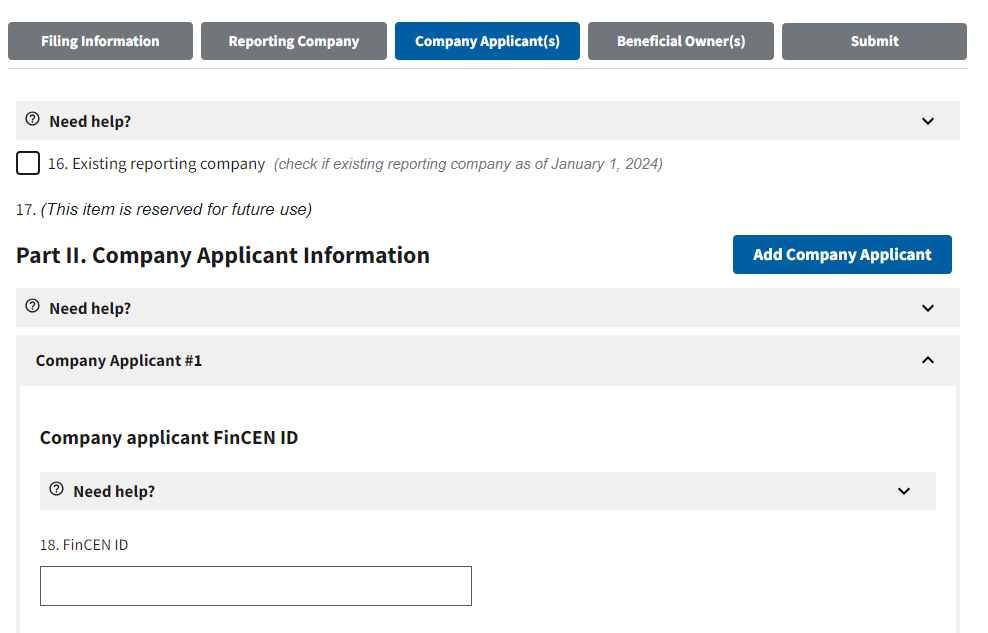

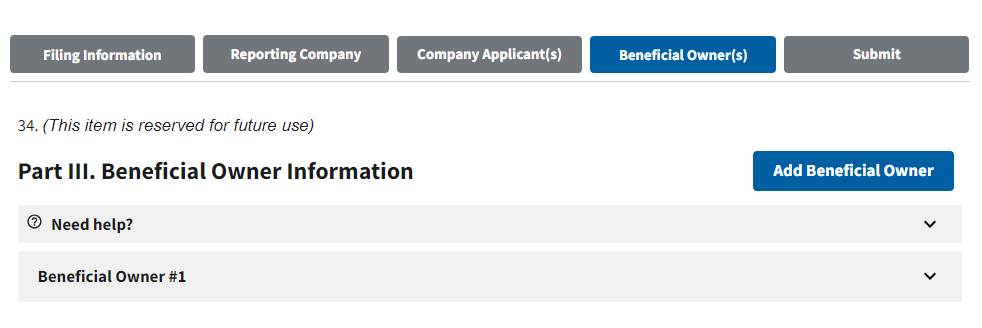

Listing Beneficial Owners

If you have a FinCEN ID, this step is greatly simplified. For other beneficial owners, the same detailed information is required. You can add multiple beneficial owners to ensure a comprehensive report.

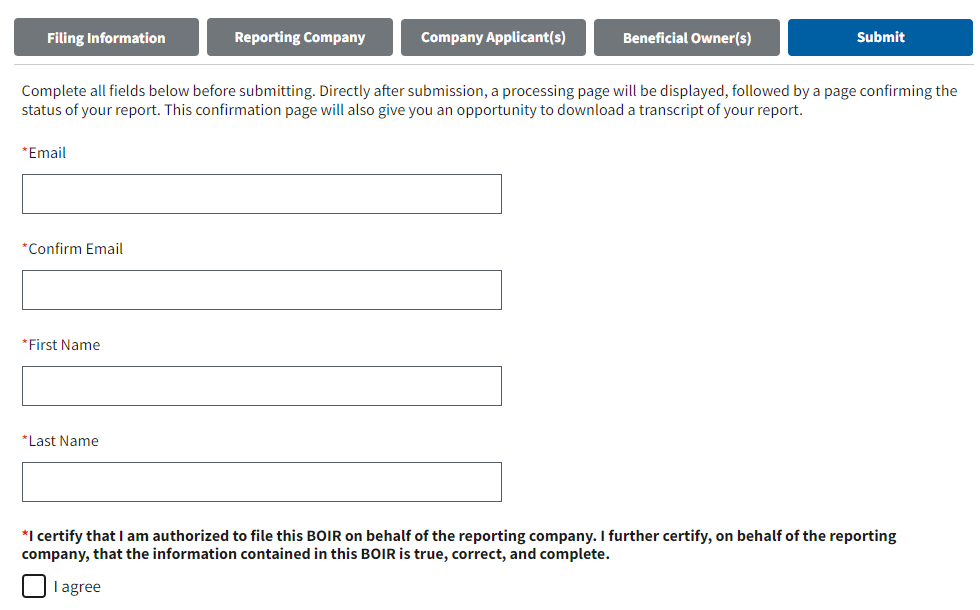

Submitting the Report

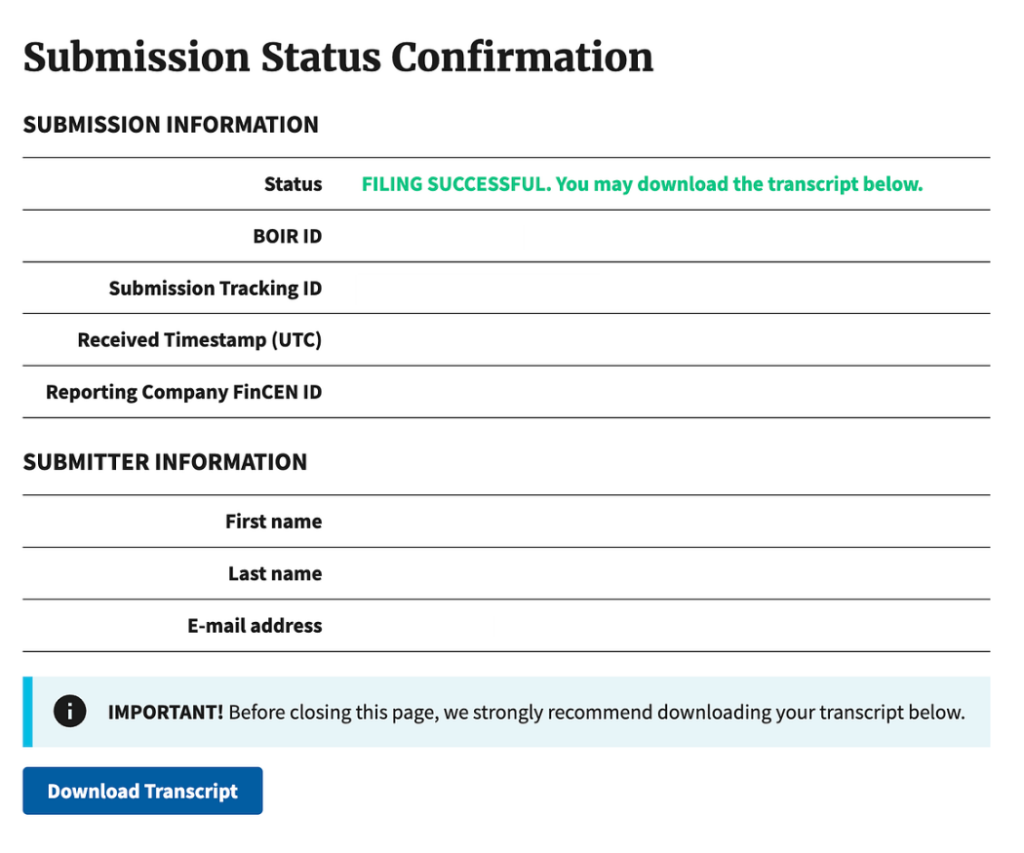

After ensuring all information is accurate, submit the report. You’ll receive a confirmation with a BOIR ID and Submission Tracking ID, marking the completion of your filing.

Key Considerations and Final Steps

Before submission, consider the implications of community property laws. In cases of doubt regarding ownership or control, err on the side of reporting to ensure compliance.

After submitting the report, keep a copy of the confirmation and download the BOIR transcript for your records. The entire process, from obtaining a FinCEN ID to submitting the BOIR, is designed to be efficient, often taking less than 30 minutes in total.

Conclusion: Embrace the Change with Confidence

The FinCEN BOI 2024 Update is a significant shift, propelling businesses towards a future of greater transparency and accountability. Understanding the nuances of the process, being meticulous in your reporting, and embracing the changes are crucial for maintaining compliance and ensuring the integrity of your business operations.

As you navigate this journey of compliance, let this guide be your compass, offering clarity and direction through the complexities of BOI reporting. Stay informed, stay compliant, and lead your business towards a future marked by integrity and trust.

Please note, this article is for informational purposes only and does not constitute legal advice or services related to FinCEN BOI 2024 compliance or BOI reporting rules.