Canada has a robust capital market, as well as a strength in funding growth ventures in emerging industries. Getting access to funding opportunities can be facilitated by becoming a public company. Below is a list of information regarding the ongoing filing requirements to be listed on the CSE. Note: this is a summary list – Please visit The CSE website for the full listing. Also be sure to check out Part 1, Part 2,and Part 3 of this 4-part series to getting listed on the Canadian Securities Exchange (CSE).

Ongoing requirements

Once a Company has successfully been listed, they must fulfill the below ongoing requirements.

Quarterly Requirements

- Unaudited interim financial statements

- Disclosure of all transactions with all Related Person(s) with the following detail

- A description of the relationship

- A description of the transaction

- The recorded amount of the transaction

- The amounts due to or from Related Person(s), and the terms and condition of those

- Contractual obligations

- Contingencies related

- Summary of securities issued and options granted during the period.

- Summary of securities as at the end of the reporting period.

- List the names of the directors and officers, with an indication of the position held, as at the date this report is signed and filed.

- Provide Interim MD&A if required by applicable securities legislation.

Monthly Requirements

- A general overview and discussion of the development of the Issuer’s business and operations over the previous month.

- Describe and provide details of any new products or services.

- Describe and provide details of any products or services that were discontinued.

- Describe any new business relationships entered into between the Issuer, the Issuer’s affiliates or third parties including contracts to supply products or services

- Describe the expiry or termination of any contracts or agreements.

- Describe any acquisitions by the Issuer or dispositions of the Issuer’s assets that occurred during the preceding month.

- Describe the acquisition of new customers or loss of customers.

- Describe any new developments or effects on intangible products such as brand names, circulation lists, copyrights, franchises, licenses, patents, software, subscription lists and trade-marks.

- Report on any employee hirings, terminations or lay-offs with details of anticipated length of lay-offs.

- Report on any labor disputes.

- Describe and provide details of legal proceedings.

- Provide details of any indebtedness incurred or repaid.

- Provide details of any securities issued and options or warrants granted.

- Provide details of any loans to or by Related Persons.

- Provide details of any changes in directors, officers or committee members.

- Discuss any trends which are likely to impact the entity.

To remain on the CSE you will need to report the following forms

- Form 5: Quarterly Listing Statement

- Form 6: Certificate of compliance

- Form 7: Monthly Progress Report

- Form 8: Notice of prospectus offering (if applicable)

- Form 9: Notice of proposed issuance of securities (if applicable)

- Form 10: Notice of proposed transactions (if applicable)

- Form 11: Notice of proposed stock options (if applicable)

- Form 12: Notice of proposed consolidation or reclassification (if applicable)

- Form 13: Amendment of warrants terms (if applicable)

Set Up Costs

Deposit fee is $5,000 (approximately USD 3,900) must be paid before the presentation of the forms. If the application is regarding a fundamental change (such as change of business, change of a fundamental transaction, etc) then an additional $15,000 (approximately USD 11,700) will need to be paid.

Now, if the applicant is not listed within three months of receiving the approval, the entity will have to pay $2,500 (approximately USD 1,900) of additional review fees. If it is not listed within six months, then $5,000 will be due (approximately USD 3,900).

Every Form 3 presented has a fee of $200 (approximately USD 155) per individual form.

Accounting Fees associated with preparing the financial statements that are in compliance with US GAAP, which will vary depending on the state of records, size, & complexity of the company.

Audit and Legal Fees – this is going to vary depending on the state of records, size, & complexity of the company.

Ongoing Costs

Supplemental Listing Fee

Any listed company must pay a flat fee of $1,000 (approximately USD 775) to list an additional class of securities.

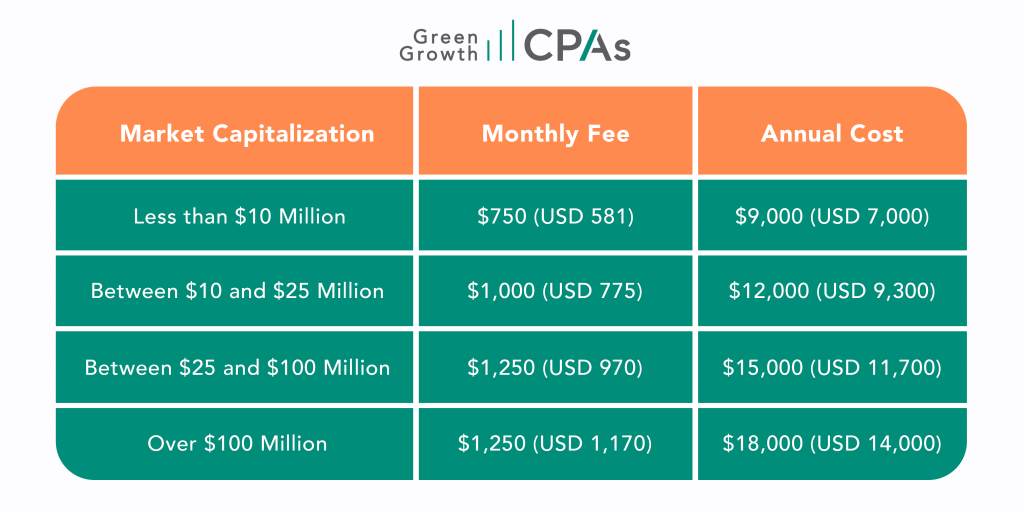

Monthly and Annual Fees

Fees will be set annually on January 1 based on the average market capitalization ($CDN) of the listed issuer for the first nine months of the previous year.

For new listings, the minimum fee will apply to the first monthly payment and subsequent fees will be based on the average market capitalization for the first 15 trading days until the annual adjustment.

Requalification Fee

If any securities are suspended from trading the entity has to pay $1,000 (approximately USD 775) to lift the suspension.

Late Filing Fee

$25 per day per form. (approximately USD 19)

Accounting Fees associated with preparing the financial statements that are in compliance with US GAAP: this is going to vary depending on the state of records, size, & complexity of the company

Audit Fees and Legal Fees -: this is going to vary depending on the state of records, size, & complexity of the company

Need Help?

To learn more about overall requirements to be listed on the CSE, then check out our How To CSE Guide contact our team of financial experts at GreenGrowth CPAs. We are here to help your cannabis venture through any level of the accounting, tax filing, or business cycle.

We employ several financial programs to assist the company with its fiscal responsibilities, including tax planning and compliance, outsourced CFO support, audit preparation, tax controversy support, and much more.

For recommendations and assistance with tax planning and accounting services, schedule a free consultation or contact us at 1-800-674-9050.