MARCH 2022

Planet 13 Cannabis Stock Research

Company Profile

Name: Planet 13 Holdings Inc.

Ticker: CNSX: PLTH, OTCPK: PLNH.F

Sector: Healthcare

Industry: Pharmaceuticals

Country: USA

Fiscal Year End: December 31

Founded: 2002

CEO: Robert Allen Groesbeck

Website: https://www.planet13holdings.com/

Market Cap (in USD): 562.42M

Current Price per share (in USD): $ 2.71 (OTCPK)

Business Summary: Planet 13 Holdings Inc., is an integrated cannabis company headquartered in Las Vegas, Nevada. Above all, they cultivate, produce, distribute, and market cannabis and cannabis-infused products for medical and retail cannabis markets in Nevada.

In addition, the company provides cardholder process navigation services; individual consultations; compassionate care programs; patient education services; express services; home delivery services; and curbside pick-up services.

Lastly, it operates a coffee shop and pizzeria.

The company owns and manufactures cannabis products under the HaHa, Dreamland, TRENDI, Medizin, and Leaf and Vine brands.

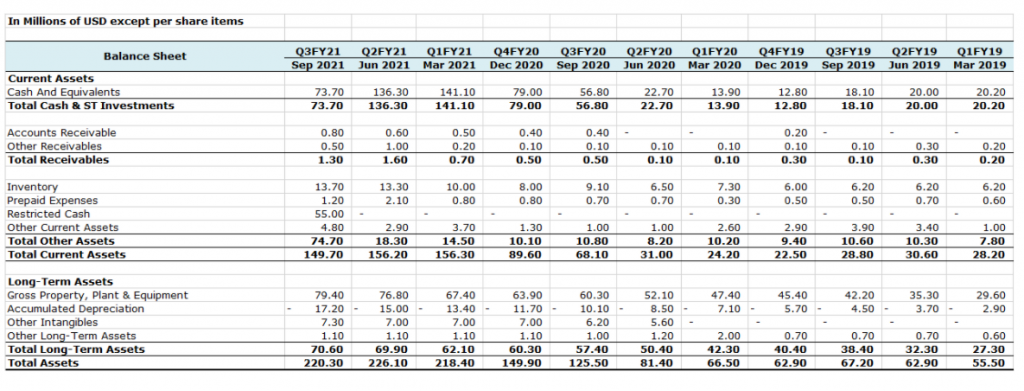

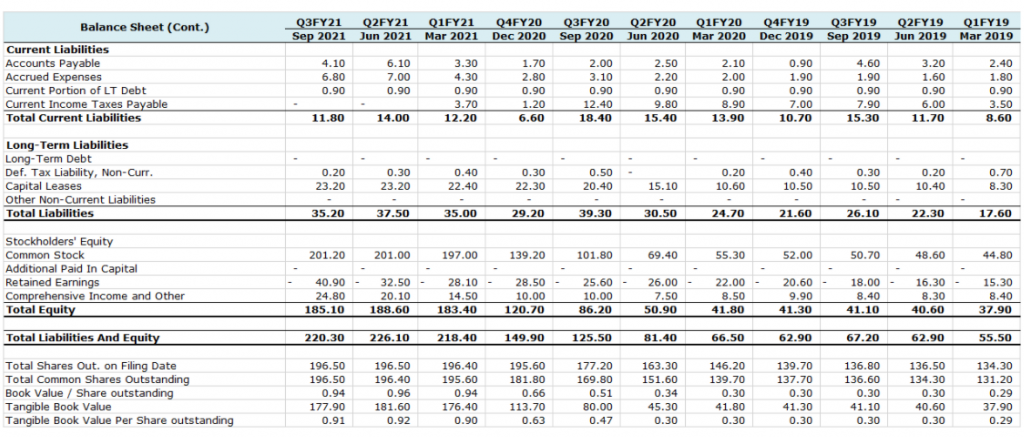

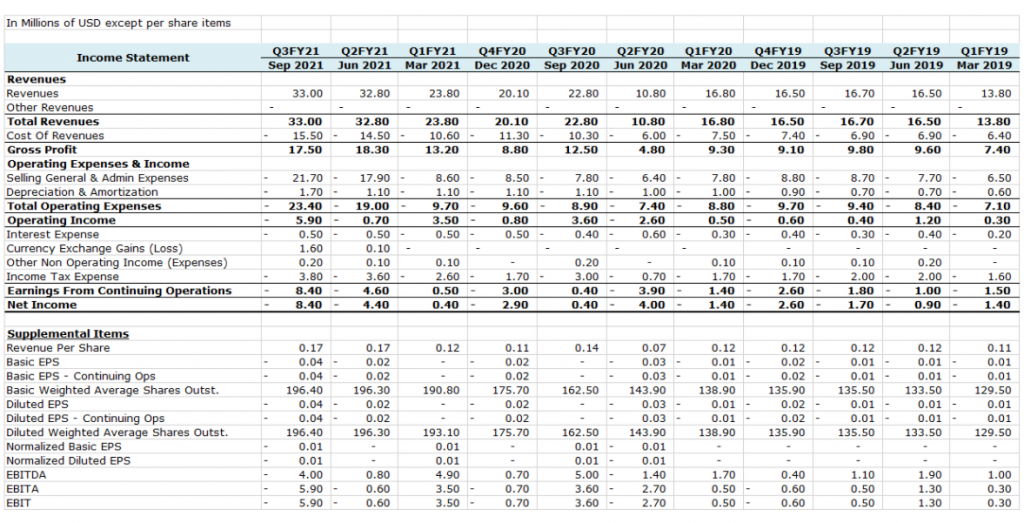

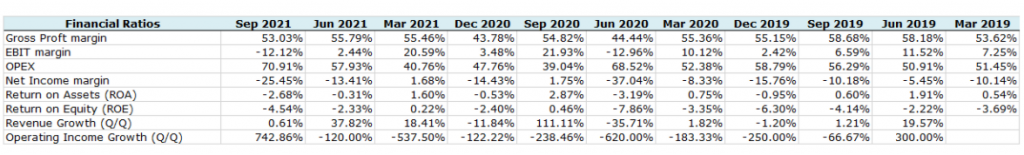

Financial Information

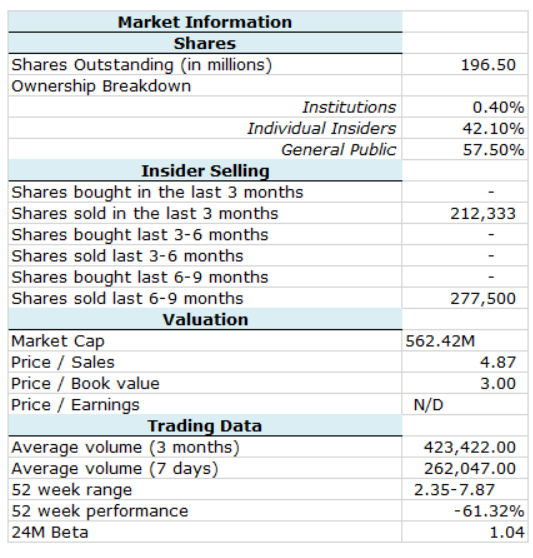

Market Information

Technical Analysis

Planet 13 Holdings Inc. is trading at $2.71. This is nearly the low range of its 52-week range of $2.35 to $7.87 (notched one year ago). Moreover, from that upper range, the stock is in a clear downtrend. Although, that places shares almost 31% below its EMA200 (rose-colored line).

Closer in time, shares are within a lateralizing behavior that began in mid-December 2021 that should need to be broken to define a new trend.

The stock has a support area in the range of $2.50/2.70 which investors should look at to start adding bullish positions. Although, if the stock claims to break the short-term downtrend here’s what we could see. Firstly it should break the upper channel side around $3.30/3.50 and then has a resistance around $4.00 / 4.15 that would enable an upside of potentially 45% up to EMA200 from current values.

However, if the stock breaks down its $2.50/2.70 support area, it could easily reach the channel downside around $1.40. In other words, this represents a potential -48% from the current value.

From a technical point of view, the stock is recommended to be included in investors’ watchlist and could trigger a bullish case in case it breaks their short-term downtrend around $3.30.

Business Overview

Planet 13 Holdings Inc represents one of the most appealing entities within the cannabis sector to follow its evolution during 2022.

There are many key drivers to look for this stock that will be exposed hereinafter:

1. Expansion plans in California:

On March 2nd, 2022, Planet 13 Holding Inc and Next Green Wave Holdings (OTCQX:NXGWF) have completed the previously announced agreement pursuant under which Planet 13 has acquired all the issued and outstanding common shares of Next Green Wave (NGW), for total consideration of C$91M (approx. USD 72M). Under the terms of the agreement, shareholders of NGW are receiving 0.1081 of a common share of Planet 13, and $0.0001 in cash, for each NGW Share held.

However, one of the main goals of pursuing this agreement is the chance for Planet 13 Holding Inc. to become a broader operator in California. Their likely addition of more stores and benefiting from vertical integration, brand and products extension, and establishing a platform for expansion to generate economies of scale.

2. Expansion plans in Florida

Planet 13 Holdings Inc. is seeking a future expansion into Florida with marijuana SuperStores in cities like Orlando since it has entered into a definitive license purchase agreement with a subsidiary of Arizona-based Harvest Health & Recreation Inc. for its state Medical Marijuana Treatment Center license for $55 million, subject to regulatory approval.

3. Long-Term positive Outlook beyond Covid headwinds

Despite Q3FY21 miss on Revenue related to continuing Covid headwinds and inflation impact on OPEX that resulted in a less than expected adjusted EBITDA, expansion plans explained in A) and B) represents a meaningful opportunity to contribute for Planet 13 Holdings Inc financial performance either through the buildout of initial assets or the potential acquisition of an established operator within the state.

An interesting topic to remember is that Planet 13 Holdings Inc, is required to have at least six open dispensaries and cultivation assets in Florida by next October in accordance with the state´s licensing guidelines.

Analysts that cover the stock believe that further expansion will come through vertical integration oriented M&A both in California and Illinois and retail assets in tourist cities like Los Angeles, New York, and Philadelphia.

Conclusion

Therefore, after going through the review of financial and business-related research along with the cannabis stock´s price technical analysis, we shall conclude that Planet 13 Holdings Inc. could be graded as a “Wait and See” stock at least in the short-term awaiting for Q4FY21 financial performance and its Covid-related impact, development of expansion plans in California and Florida and from a technical perspective a reversal of the current downtrend.

Interested in taking your cannabis company public?

We can help! To learn more about going public, reach out to our team of financial experts at GreenGrowth CPAs. We are here to help your cannabis venture through any level of the accounting, tax filing, or business cycle.

We employ several financial programs to assist the company with its fiscal responsibilities, including tax planning and compliance, outsourced CFO support, audit preparation, tax controversy support, and much more.

For recommendations and assistance with tax planning and accounting services, schedule a free consultation or contact us at 1-800-674-9050.