The beginning of 2023 brought significant changes to excise tax rules for California retailers. While many are trying to adapt, some are still struggling to calculate their excise tax correctly, putting them at risk of incurring heavy penalties. In this article, we’ll examine the changes to the excise tax rules that took effect on January 1, 2023, and discuss the common mistakes retailers are making, as well as how to avoid them.

New Excise Tax Rules for Retailers

Prior to January 1, 2023, retailers would pay distributors at 27% of the wholesale cost as excise tax. Distributors were responsible for remitting these taxes to the California Department of Tax and Fee Administration (CDTFA). However, the rules changed in 2023, shifting the responsibility of paying the excise tax from distributors to retailers. Now, retailers charge their customers a 15% excise tax and are responsible for remitting it to the CDTFA themselves.

The importance of accurate excise tax calculation cannot be overstated, as the penalty for underpayment is a staggering 50%. Therefore, it is crucial for retailers to understand the new rules and California excise tax calculations

Common Mistakes Retailers Are Making

1. Not accounting for purchases made in 2022 but sold in 2023

One of the primary issues retailers are encountering is the failure to account for purchases made in 2022 that were sold in 2023. Under the previous excise tax rules, retailers had already paid excise taxes to their distributors for these products in 2022. As a result, they need to ensure that they don’t double pay the excise tax on these items under the new rules.

Retailers can claim a deduction for the excise taxes paid on these products in 2022 by reporting them in the appropriate box on their tax return. This will help avoid double taxation and ensure that the retailer only pays the excise tax once.

2. Incorrectly calculating excise tax based on net sales

Another common mistake that retailers are making in their California excise tax calculations is using net sales as the taxable base when calculating their excise tax in their Point of Sale (POS) system. However, the correct taxable base should be net sales plus local tax.

Using net sales as the taxable base results in a significant underpayment of excise taxes, which can lead to hefty penalties. To avoid this issue, retailers need to ensure that their POS system is set up to calculate the excise tax based on net sales plus local tax.

Examples of Underpayment

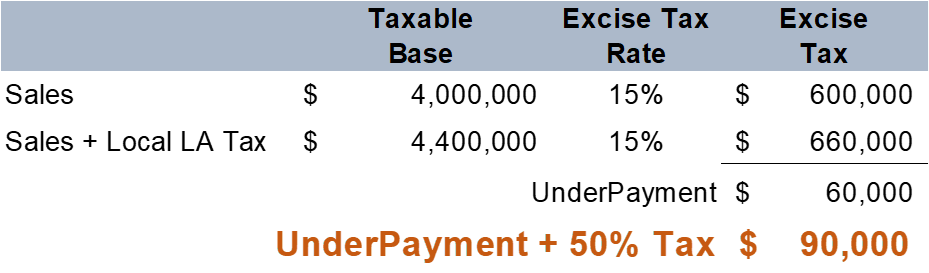

Let’s consider an example to demonstrate the impact of incorrect excise tax calculation:

A business has sales of $4,000,000 and a local LA tax rate of 10%. The correct taxable base should be $4,400,000 (sales + 10% local tax). Using this base, the excise tax would be $660,000 (15% of $4,400,000). However, if the business calculates its base using sales alone they would only pay an excise tax of $600,000 (15% of $4,000,000). This results in an underpayment of $60,000 and an underpayment fee of $30,000!

Need Help with Excise Taxes?

GreenGrowth CPAs helps our clients navigate these and other regulation changes everyday. Contact us to learn more about how we can help you calculate and file your taxes with ease. We have several financial programs to assist companies and individuals with their fiscal responsibilities, including tax planning and compliance, accounting & finance support, audit preparation, tax controversy support, and much more.