Looking for reasons to file your business taxes before the extension deadline? There are many benefits of filing your extended taxes before the deadline and virtually no downsides. No one wants to make mistakes when filing their tax return. Rushing to meet the tax deadline makes it more likely that potential costly errors will occur. Getting started early means no hurrying and less likelihood of mistakes.

Accruing Interest & Penalties

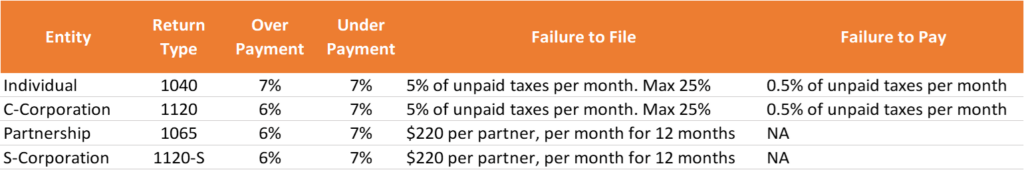

Even if you’re on extension, you’re still accruing interest and failure to pay penalties on any potential balance due, and this can add up quickly. By filing early, you can avoid these unnecessary fees. You can find out more about the penalties here.

Payment Planning & Gathering Funds

Filing early gives you the opportunity to plan ahead and create a strategy for making your tax payments. Just because you file now doesn’t mean you will incur any additional penalties than you normally would for late payments and it does not change the extension due date. In fact, filing early prevents the potential for a late file penalty to incur and allows you to know exactly where you stand with your tax liability which gives you time to make cash flow choices to pay your taxes on your terms. Yes, you will still accrue the additional fees mentioned above until the balance is paid. However, you now have more time so you can make payments as you go or simply take the extra time to gather the funds needed to pay by the extension deadline.

Waiting until the deadline to file doesn’t give you much time to gather funds for payment. Filing early gives you the time you need to plan and gather the funds needed to pay your taxes. If you don’t find out your balance due until a few days before the deadline, you don’t have much time to come up with the funds. This causes unnecessary stress.

Early Filing Reduces Stress

Filing your taxes can be a stressful process. By filing early, you can reduce this stress and enjoy the peace of mind that comes with knowing your taxes are taken care of. If the delay in filing is due to the stress involved with preparing your documents and books for filing, now is the best time to reach out to your accountant to assist you with what information you need and even help with cleaning up your books. Time is limited as the deadline approaches so it’s harder to receive the hands on help if you wait.

Keep Investors Happy

Investors face all of the same stressors and challenges listed above when they receive K1s from an S Corporation or Partnership. While the entity itself doesn’t necessarily need to plan ahead for the tax liability, the investors receiving the K1s do. The best way to support your investors with the stressors of taxes is to provide them their K1s as early as possible. This allows them to work with their accountants to plan ahead and reduce the potential interest and/or penalties.

Protection Against Identity Theft

Benefits of filing extended taxes before the deadline include protection against identity theft. Tax refund fraud is a real issue costing taxpayers millions each year. The issue arises when thieves try to beat you to filing to claim your return. The sooner you file, the lower your risk.

More Time with a Professional

An experienced tax preparer is worth their weight in gold. Preparers’ services often pay for themselves with what you save in deductions and liability mitigation. Tax preparers can do even more if they’ve got the time to work through your books. Around filing deadlines preparers are swamped, so it’s better to prepare your returns in the offseason, even if you don’t want to file until the deadline.

Need Help Filing?

Don’t wait until the last minute to file your taxes. Take advantage of these benefits during the off-season and prepare or file early. Contact us today to learn more about how we can help you file your taxes with ease and confidence. We have several financial programs to assist companies and individuals with their fiscal responsibilities, including tax planning and compliance, accounting & finance support, audit preparation, tax controversy support, and much more.